Within the past year, around $70 million has been locked in the Synthetix DEX (Decentralized Exchange). Today, the exchange announced that their mobile app was discontinued so that the team could focus on other things.

Synthetix has sat atop the DeFi Pulse “value locked” list for quite some time, trailing closely behind Compound and Maker. Given recent hype around DeFi, it might seem strange that the DEX doesn’t find maintaining a mobile app worth while.

If you were one of the few viewers of the DeFi.WTF event at DevCon 5, the decision wouldn’t have been as much of a surprise.

Who uses decentralized exchanges?

Not many people.. that’s for sure. In the past 24 hours, Synthetix has done about $1.7 million in total volume while BitMex is at $1.6 billion.

Totle conducted research in June which resulted in a headline saying “DEX volume has tripled since January.” Still, June only held around 300 million in monthly DEX volume. Yet, the hype still lives, as YouTubers are saying that Ethereum’s DeFi will “spark the next bull run.”

At DevCon 5, even DeFi developers didn’t seem as excited as the YouTubers.

There was a lot of talk about the lack of volume and how to handle long tail assets. Long tail assets would be referring to niche products that don’t sell much. Lack of volume solidifies the fact that things aren’t selling.

Not many people are trading niche ERC-20 pairs, and they aren’t getting a discount on bigger tokens either. According to Tom Schmidt from 0x, aggregated exchanges are experiencing increased volume because people have wasted money by not checking prices.

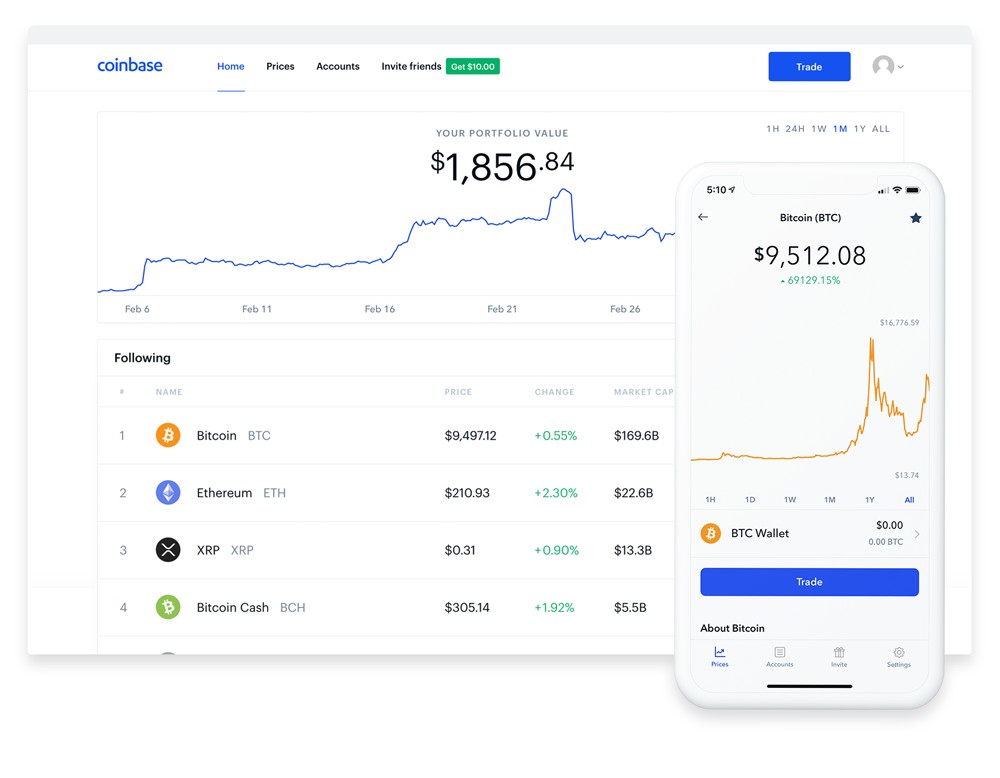

Still on an aggregated (think Priceline) DEX such as dex.ag, someone who wants to trade USDC for Ether isn’t getting a better deal than they would on Coinbase.

Mobile apps are secondary for traders

Exchanges require more screen real estate to navigate than Instagram. Binance has a pretty solid mobile app, but most people still prefer the multi-monitor meta when it comes to planning and executing trades.

If a company is competing in a new and constantly evolving field, it makes sense to keep things lean and mean. A mobile version of anything is welcome in my book, but for those who manage large amounts of capital, doing work on their laptop is probably native anyways.