Note: This is not financial advice.

Crypto exchanges with leverage are sketchy. BitMEX requires no KYC, has an unofficial kill switch and is already so illegal that they could disappear with all of your money and still have the same amount of GTA wanted stars.

On the other hand, they require no KYC and offer crazy high leverage. This combined with the nature of storing BTC creates an uncommon situation. A situation where you can store USD value in a place safer than an exchange yet still use that money speculate.

BitMEX is still the best leveraged exchange with no KYC

One of my favorite features about the crypto space the ability to easily access financial instruments. In particular, perpetual swap contracts.

All you need is an e-mail account and a password in order to short, trade futures and lever your trade x100.

Certainly, leverage tapers off as your portfolio size increases, but many people who keep under $10,000 will have enough leverage to use this strategy of hedging against exchange risk.

Exchanges that offer these features are not trustworthy. Some of their CEOs are being tracked by the U.S. government, others have gotten hacked and suddenly went bankrupt after a bunch of people’s bitcoin got stolen. All in all, it’s just a very unregulated environment.

The safest option is to hop on Coinbase Pro and trade with comfort, but what if you want access to leverage and no KYC? If you want those two things, the only options you have put yourself at higher risk.

Then, your best choice is the exchange that’s under investigation by the CFTC for letting Americans trade, BitMEX. They don’t have withdrawal limits, there’s decent liquidity and if you accidentally log in with a restricted IP, they have a history of letting you withdraw funds before verifying identity.

Perpetual swap and futures hedging

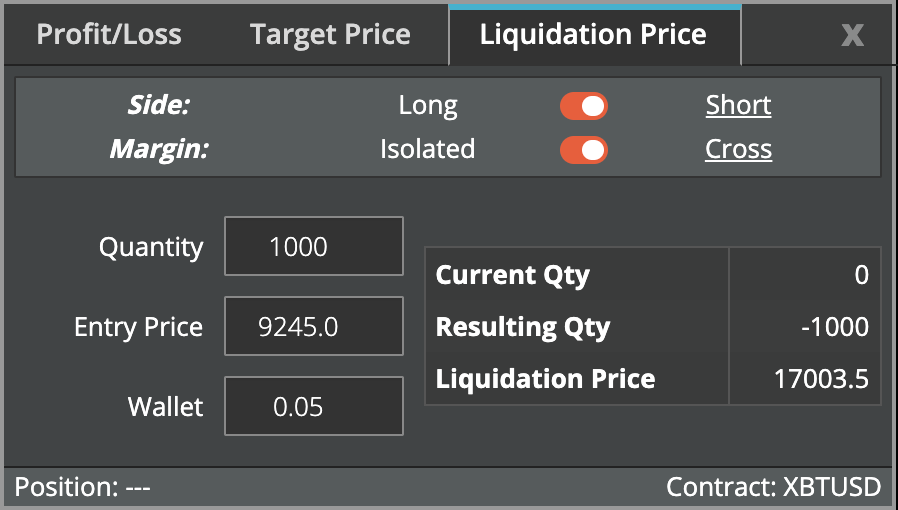

BTC is the only currency BitMEX wallets support. In order for your wallet to follow the value of USD, you will need to short the equivalent to your BTC balance in either the futures or perpetual trading contracts.

In theory, you can comfortably keep about only 50% of your portfolio on the exchange. Unless the price of Bitcoin doubles within a period that you are unable to access a computer, you will not get liquidated.

The other 50% should be in your wallet. It will stay hedged against the price of BTC as long as you are in a short position.

In doing this, there’s still enough leverage to use on short term swings and scalps. (in typical market conditions) If you’re running low on margin, it’s easy to transfer more over from your wallet.

Best way to stay in a cash position on BitMEX

Reducing exchange risk revolves around shorting more than your balance in the exchange. Sadly, if you want to continue to speculate with remaining margin, the best method is to short a futures contract.

These contracts have expiry dates at some point in the future and range in price. Their price action is highly correlated to BTC; the spread is due to the nature of futures contracts. If you don’t want to have to pay attention to your position in it, just pick whichever contract expires at a later date.

Since the perpetual contract trades with much higher volume than future contracts, it is more liquid and better for timing out precise trades. It is also more closer to the consensus price across all major exchanges.

On BitMEX, users pay funding in order to keep the contract price closer to its reference price and mimic true margin trading. The funding is typically positive, which means longs pay shorts the interest. If you are 100% short, you’re essentially in a cash position while benefitting from a .01% payment on your total position size every 8 hours.

If funding is negative, meaning shorts pay longs, then you will likely make your money back when funding turns positive.

Keep the rest in your wallet

You need to be ready to send BTC to BitMEX quickly if your liquidation price is nearing. If you are losing PNL in the form of BTC, you will need to resupply your BitMEX balance occasionally after large price moves.

If there is a situation like the COVID-19 BitMEX dump, when price quickly dropped from 9k to 3k, you will need to be able to easily access funds to replenish your balance with. It can be inconvenient, depending on how often you trade the specific contract.

If you have unrealized PNL due to a long term downtrend, closing your position is necessary if you need all USD relative value to trade with.

The trade off

With lower exchange risk, you take on increased responsibility for managing funds on the account. Unless you know how to connect with your wallet and BitMEX’s API, it might be a bit of a chore to manage by hand.

When you consider benefits received from funding, security, and the convenience of a synthetic USD position, it can be a compelling circumstance to be in.

Disclaimer: Only trade on BitMEX if residing in an authorized area