Note: We are not financial advisors and this is not to be taken as financial advice

COMP quickly established itself as the second highest valued token within the Ethereum DeFi ecosystem after launching. But just how is it that COMP is around 200x more valuable than other tokens in the ecosystem?

Value locked metric

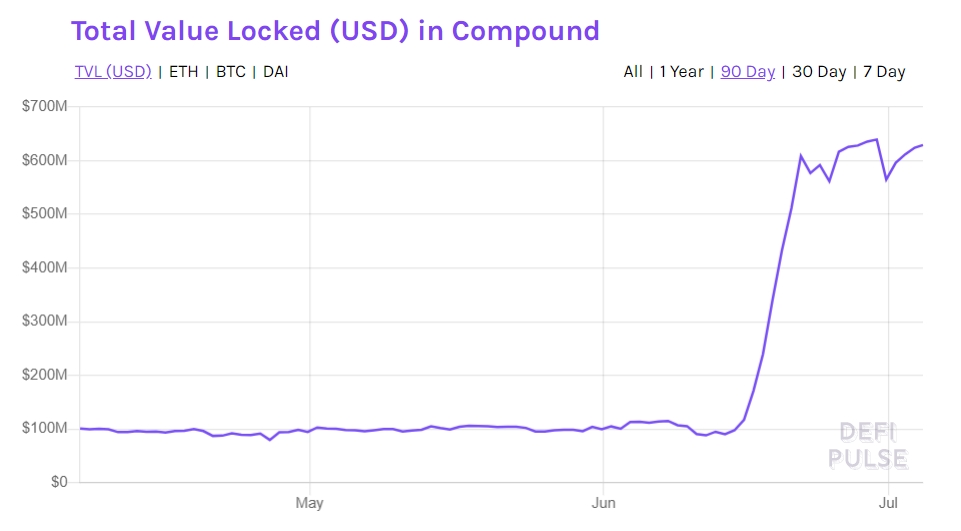

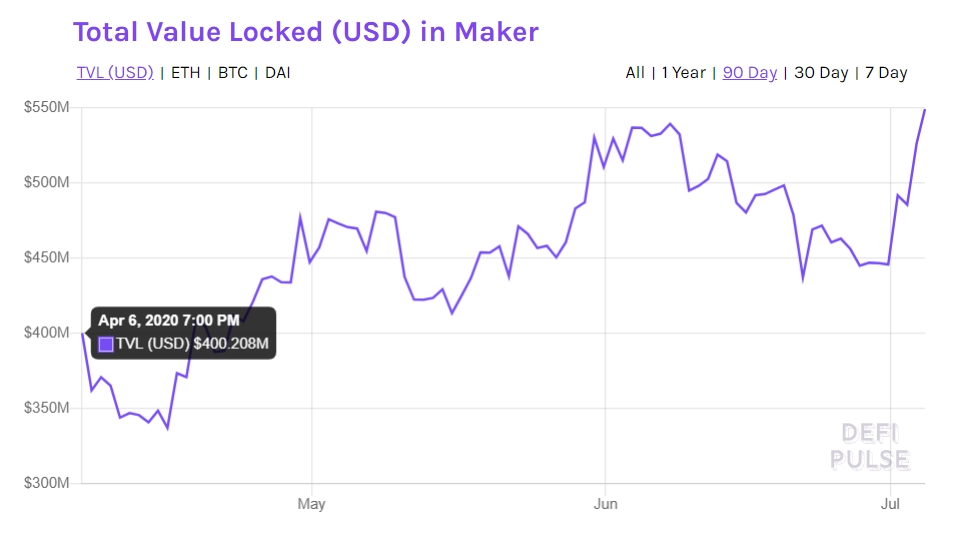

Compound, Maker and Synthetix have led the ‘value locked‘ metric on DeFi Pulse for quite some time, but Maker and Compound are price higher and have been around longer. In terms of how token price correlates with value locked, MKR is not correlated, SNX is very correlated and COMP still needs time to play out.

Looking further into the value locked vs price relationship:

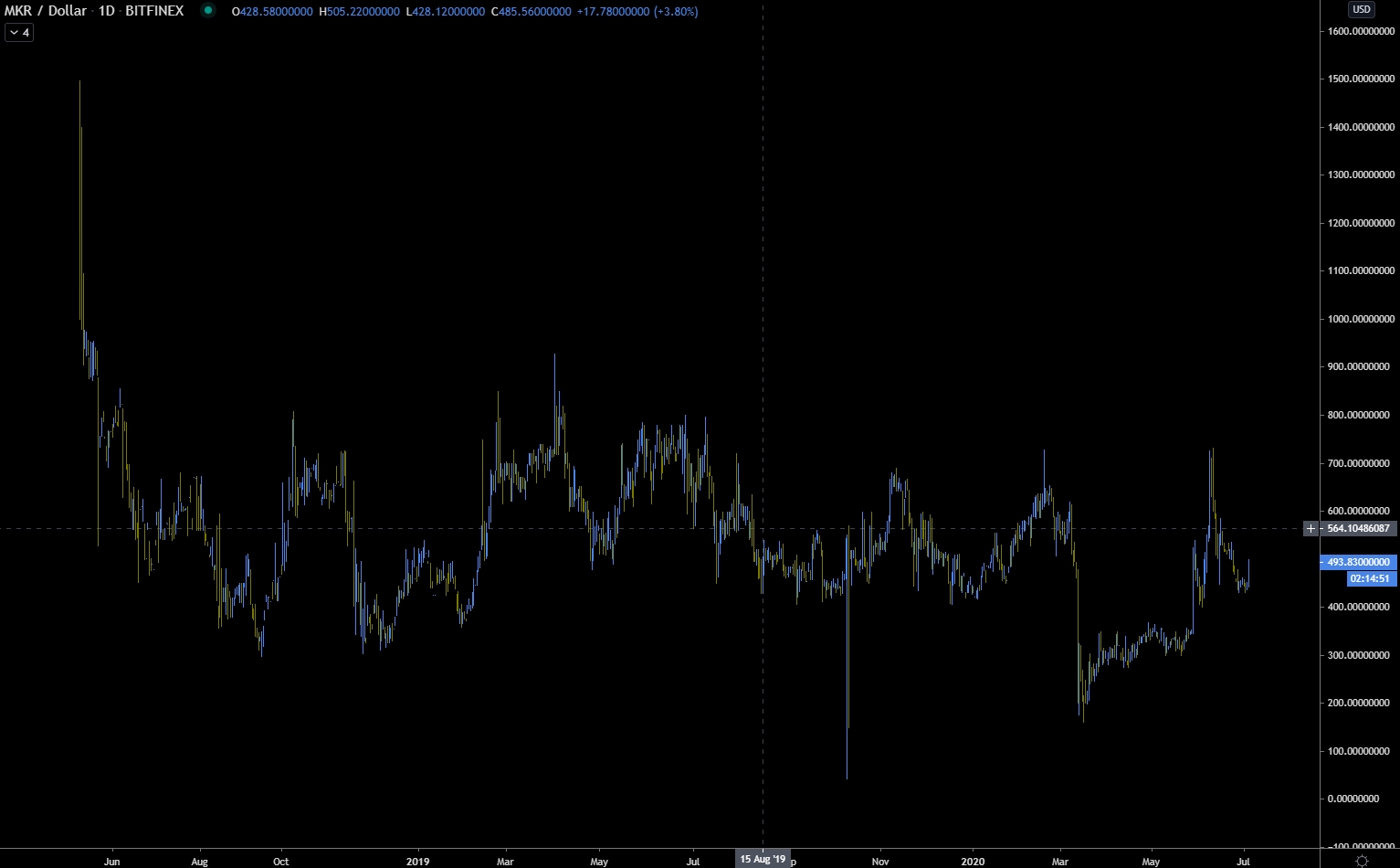

- MKR was released in 2018 when there was $100 million already locked. ICO price was around $1500 and now is $436

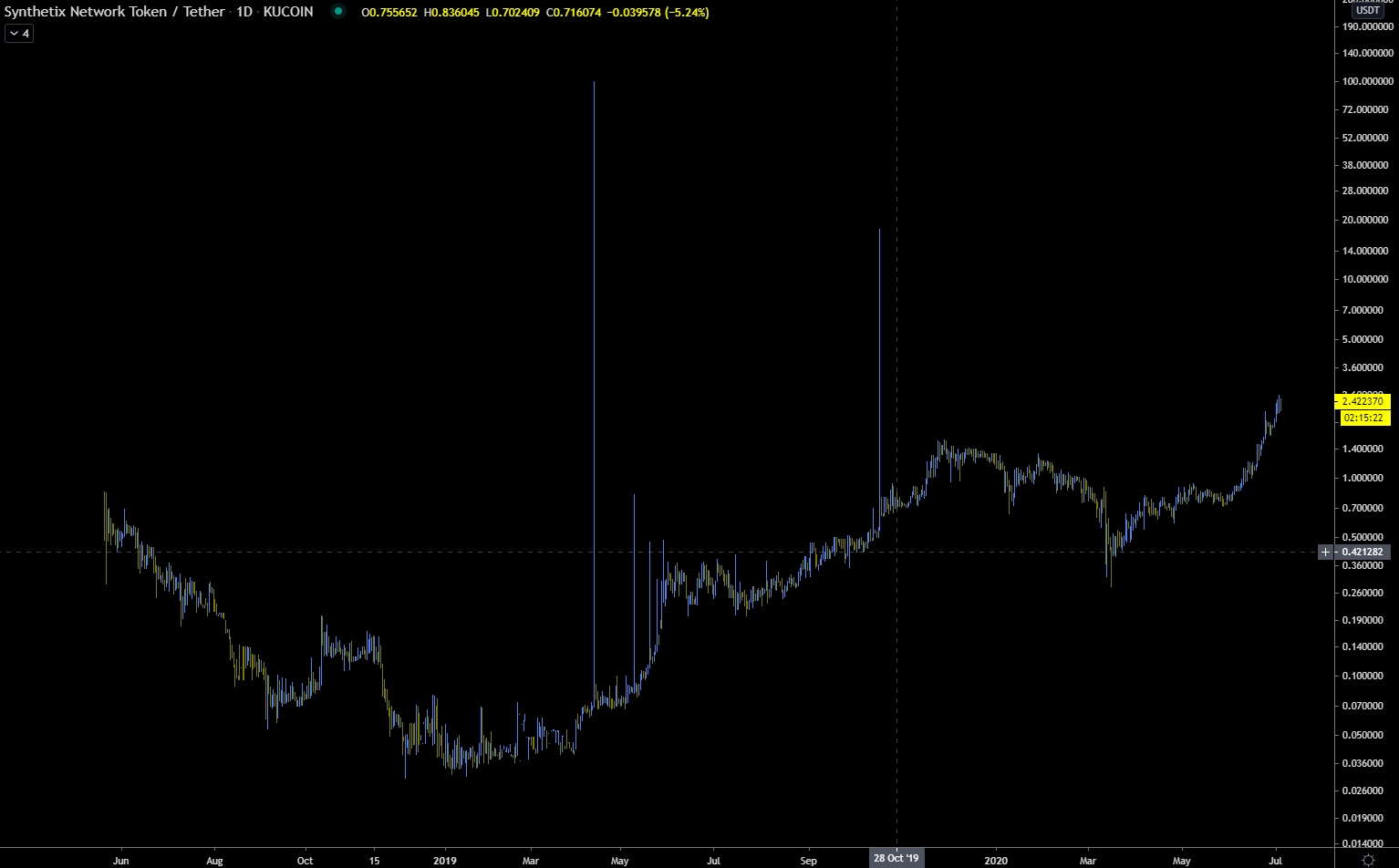

- SNX was rebranded from HAV in 2018. There is no data for value locked until $1.69 million in 2019. The ICO price was $0.84 and now is $2.40.

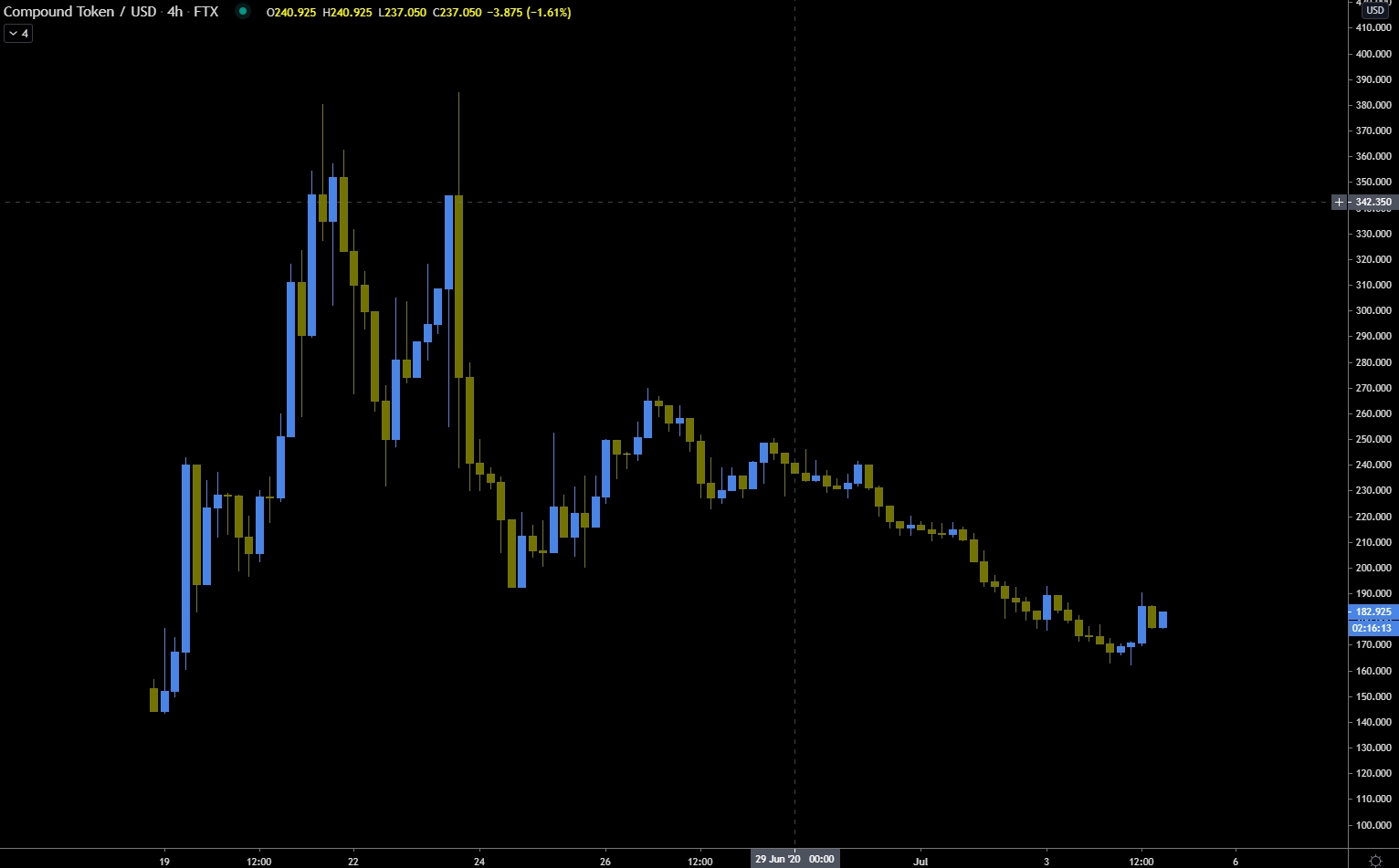

- COMP had around $400 million locked when the token was released in 2020. It quickly peaked at $381 and is now trading in the mid $100 range. Not long before COMP’s ICO, they had about $100 in locked value

MKR’s path to value

MakerDAO had been around for some time, but wasn’t publicly governed until MKR listed on exchanges in 2018. This token ended up being exceptionally valuable, which implies that there is strong interest in governing DAI. Additionally, MKR is burned as a function of DAI fees which promised to deflate the token.

MKR listing at around $1500 and quickly falling to around $500 insinuates that the token was overhyped, but worth significantly more than many other tokens. Right now it’s sitting around $500 and is the second highest valued coin.

Since it’s initial drop, MKR has traded sideways for two years. It was a relatively difficult token to come by until it was listed on Coinbase in 2020, but the sidways trading has persisted.

MKR holders might have a higher tendency to use its functions rather than speculate if they have any stake in DAI’s success, which many DeFi platforms rely on for business. Regardless, as time has gone by, DAI has experienced structural improvements, exponential adoption and MRK still fails to show a bullish or bearish trend.

Keep in mind, compared to other Ethereum based DeFi assets, it is very expensive.

SNX was next

Throughout 2019 and 2020, Maker and Synthetix contested the top 2 value locked spots, but their tokens differed greatly in terms of price. DeFi adoption during this time drove SNX up to a new high of $0.37 from an all time low of $0.30 while MKR traded sideways in the $400-$500 range.

While DAI is a trusted decentralized stablecoin, Synthetix also allows users to mint sUSD (their own stablecoin) with decentralized collateral. DAI is much more focused on being the go-to option, but technically, they aren’t all that much different.

SNX is also used for governance over parts of the Synthetix platform, but theirs is much different than Maker’s. It all revolves around trading decentralized derivative products that follow stocks and commodities. It is relatively limited at the moment, but their founder has spoke about adding new products and leverage mechanisms. The cool thing is that it was the first of its kind and works fairly well.

Still, wanting to purchase gold or S&P shares on a decentralized platform using ERC-20 tokens is more of a niche appeal than the service that DAI provides. The million dollar question is whether it is really 400x more niche.

Finally, Compound

DeFi’s most popular stablecoin, DeFi’s approach to synthetically tokenizing financial assets and their respective tokens are coming to fruition. Next comes a token from DeFi’s biggest open lending pool.

Compound allows anyone to contribute to the lending pool, or borrow as long as they are over-collateralized. All of the lent money is kept in a pool so anyone can instantly withdraw what they are lent - as long as it does not exceed total lent value of the pool.

They also are able to seamlessly extend their protocol to other apps. Dharma, for instance, made a simplified interface for Compound, so that they could market to a more inexperienced demographic.

The odd thing about Compound is that they hadn’t even hit Synthetix’s level of value locked until days before it even had a price. Just before and after COMP went live, value locked jumped from $100 million to $1.3 billion and counting. Value locked on the release date was $339 million and COMP was listed at $144.

The release was accompanied with an ability to receive free COMP tokens simply by participating in the network, but it was abused and short lived. “Yield farming,” the term for farming COMP tokens now offers much lower returns and Compound, in general doesn’t have great lending side APY at the moment. As all of these changes happened, value locked in compound stagnated.

COMP has only been listed for a month at the time of writing and its price has ranged from $140 to $385. The push from $140 to $385 happened quickly after the launch on FTX, but dropped back down to $192 shortly after its listing on Coinbase.

Again, people have found this token to be much more valuable than other DeFi products, but this could have been a reaction to yield farming rewards. Since the coin is in it’s adolescence, things still need to play out.

it’s easy to assume that people will lend and borrow more in DeFi than buy synthetic gold or stock positions, but Compound requires borrowers to over-collateralize. This narrows the demographic to people who want to hold a position in one token while having money to speculate on others.

Some have borrowed in this manner to refinance their mortgages, but the volatility in APR has come back to bite them. Sometimes compound can give you better rates than your mortgage or credit cards, but it can change at any moment. In addition, there is a looming threat of liquidation due to your collateral’s volatility, which many people dealt with during the March 2020 market crash.

One major catalyst to look out for when it comes to progress in the lending space is zero-knowledge proof applications, which eventually will allow someone to prove their identity without exposing it.