When learning about Bitcoin and the stock market, often times one will consider day trading before even knowing what dollar-cost averaging (DCA) is. This is because dollar-cost averaging is super boring. It requires patience and doesn’t trigger the euphoria of imagining a leveraged trade making you more in a day than your job pays per month.

Still, DCA is probably one of the smartest ways to manage an investment. Chances are, you don’t have time to learn the ins and outs of a market and even if you do, you’ll likely be losing money for a significant amount of your learning process. less than 10% of day traders make money, so before taking the risk, check out the returns you can get from dollar-cost averaging.

How to calculate Bitcoin dollar-cost averages

Dollar-cost averaging is pretty simple. It’s a technique where you deposit an equal amount at a consistent frequency over a certain amount of time.

One of the easiest ways to learn what you could have made by dollar-cost averaging for a certain amount of time is on dcabtc.com. Here, you can set up imaginary situations to see what you missed out on. First, set up the amount deposited, then choose the frequency, then how long you have(‘nt) been accumulating for.

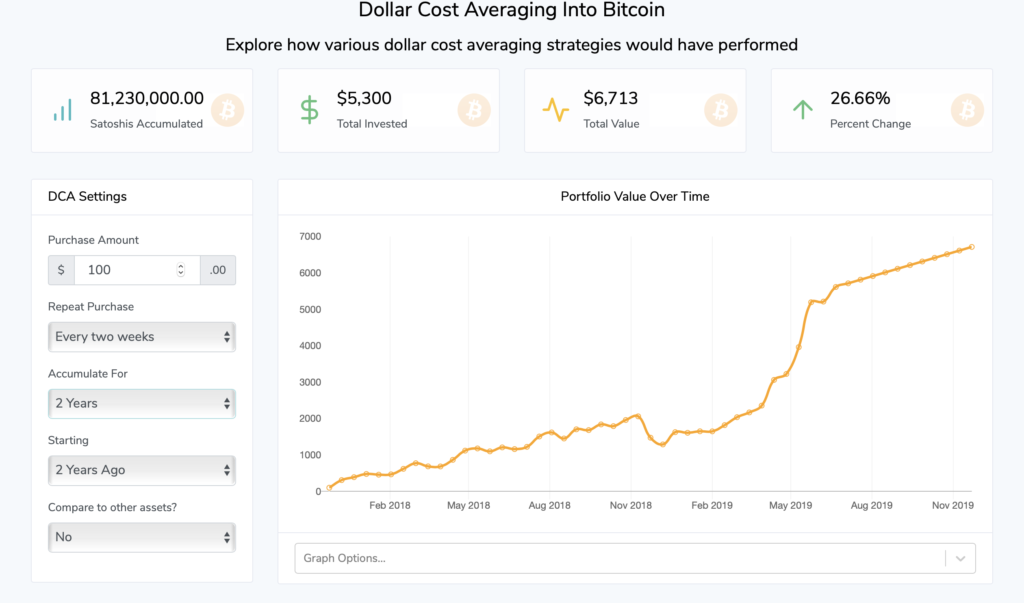

So, let’s prove how effective DCA is by starting to accumulate during the beginning of the biggest crash Bitcoin has seen, in January 2018.

As you can see, if you had started investing equal payments every other week into Bitcoin since January 2018, you would have received a total of 26.66% return. I chose to deposit $100 bi-weekly, which landed with around $1,400 in profit, but if you had deposited $500 bi-weekly, total profit would be around $6000.

Now, let’s say you were a bit smarter and didn’t start averaging at the top of Bitcoin’s parabola. If you had invested $100 bi-weekly after Bitcoin’s final capitulation in December 2018, your returns would be increased to 50%. This would result in $1400 of profit within about 12 months.

Why averaging in is effective

If you think about it, it’s kind of difficult to keep putting money into an asset when its value is decreasing for months at a time. Markets tend to reward those who are psychologically strong. The easiest way to not falter and pull out is to set up recurring payments on an exchange like Coinbase and never look at the price.

The effectiveness of DCA also depends upon the asset you are investing in. You wouldn’t see the same results averaging into XRP, which is why it’s smart to pick an asset that has proven long term growth.

There is still risk to dollar-cost averaging, but it mitigates the risk of dumping tons of money into an investment at one price point, and it doesn’t rely on you keeping track of the market. These techniques can be used on any type of investment like gold, Apple or Tesla.