Whether you are new to the cryptocurrency space or have been around for a while, the concept of a cryptocurrency wallet can be difficult to grasp. If you’re a crypto-veteran, chances are you’ve heard about several different types of cryptocurrency wallets. Understanding the differences between these wallets as well as which one to use can be a daunting task. No need to fear, however; we’ll break this complex topic up into a easy-to-understand format.

In this article, we’ll discuss desktop, hardware, online, paper, and exchange wallets, as well as answer when it is (and isn’t) appropriate to use each one.

Desktop Wallets

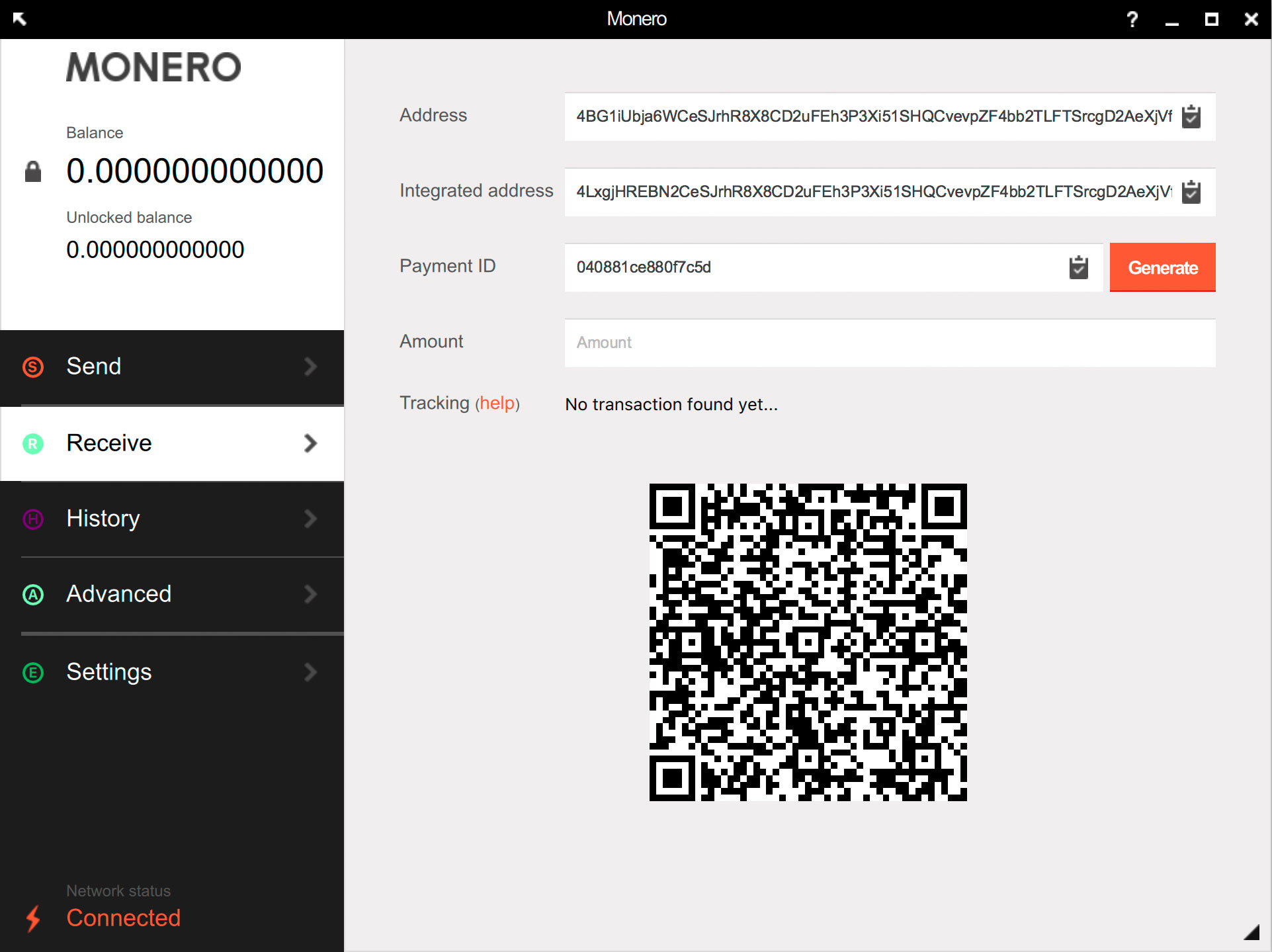

This is perhaps the most common type of cryptocurrency wallet. Desktop wallets are software packages that are installed on your average computer, often provided directly from a cryptocurrency project. They are often specific to a single cryptocurrency and require a full download of the respective cryptocurrency’s blockchain data (also known as running a full node) to function. Examples of desktop wallets include Bitcoin Core (Bitcoin), Mist (Ethereum), and Monero GUI/CLI wallet.

Advantages of desktop wallet

Desktop wallets can vary in aesthetic and function, depending on the cryptocurrency being stored. However, they generally share a few distinct traits. They are full-featured wallets, giving the user access to all the functionality that the respective cryptocurrency has to offer.

The primary reason to use one, however, is control. Desktop wallets grant full access to a user’s public/private keys and the wallet’s seed (used for restoring the wallet), allowing for user-controlled security. The only security you need is yourself, not a central authority that you must trust, such as a bank.

Disadvantages of a desktop wallet

There are several reasons why a user may not want to use a desktop wallet. The most common issues relate to the concept of downloading the a cryptocurrency’s blockchain data. If a system is unable to download the entire blockchain (due to storage or network limitations), a desktop wallet is simply not functional.

Ease of use can be diminished if a user has to sync their wallet with the blockchain every time they decide to start it up. Use of the wallet is also limited due to the general immobile nature of desktops and even laptops. Want to quickly pay for that burrito with your newly found burritocoin before your lunch break ends? It may not be feasible to whip out your laptop, start up your wallet, and sync to the blockchain, nor may it be feasible to run home to your desktop to initiate the payment.

Other issues stem from security concerns. Desktop wallets give you control over your own security, but what is one to do when their environment is not secure? A user may not trust themselves to keep the computer storing the information secure. This could be attributed to bad security practices, resulting to the compromising of private keys.

Conclusion

In summary, desktop wallets should be used when a user has access to a private system and maintains basic security practices. A user should also be confident in their technological and troubleshooting abilities, as this type of wallet can take a significant learning curve to master. Most importantly, this type of wallet should be used when ease-of-use is not the highest priority. Desktop wallets are not generally the most user-friendly. The security of these wallets can be similar to that of Fort Knox, or of a child’s lunchbox. It all depends on the user. However, desktop wallets aren’t as inherently secure as hardware wallets.

A desktop wallet is much more fit for sending moderate amounts of cryptocurrency to remote addresses for tasks like online shopping, or for storing a moderate amount of cryptocurrency that doesn’t require bulletproof security or constant access for on-the-fly transactions in varying locations. They are also necessary for tasks requiring features that are not available on other types of wallets, which is often the case for cryptocurrencies with unique functions. In terms of overall functionality, desktop wallets take the throne.

Hardware Wallets

What is a hardware wallet?

Hardware wallets are physical devices with the sole purpose of storing cryptocurrency. They securely store the private keys on the device and use encryption methods to keep your keys secure. They are often small and portable, with a method of connecting to a computer (or even a smartphone in some cases) in order to access the wallet software. These wallets are able to be restored by entering the wallet’s seed (also known as mnemonic phrase) into a similar device. Examples of security-focused hardware wallets include the Ledger Nano S and the open source Trezor.

Advantages of a hardware wallet

Hardware wallets are one of the best ways to securely store cryptocurrency without losing basic functionality. Wallets like the Ledger Nano S or Trezor boast security that would allow the device to be plugged into virtually any system without risking compromising a user’s private keys or other sensitive information — which could result in stolen funds. Private keys are stored on the device itself, so it is not necessary to put your trust into the security of a personal computer. In the case of physical theft, a pin or another method of user-chosen security is often required to access the device. This slows down the thief while you grab your replacement hardware wallet, enter your seed, and transfer the money out of your restored wallet.

Despite the high level of security provided by hardware wallets, their ease-of-use can be surprisingly high in certain areas. Hardware wallets are portable and do not require downloading and syncing of a full blockchain. Setting up the wallets are easy and the software interfaces are designed to prevent user error and simplicity. All that is needed is internet access to perform functions, such as sending transactions and checking balance, as well as a compatible device to interface with the hardware wallet.

Disadvantages of a hardware wallet

First of all, hardware wallets do not contain full-featured wallet software. The software is usually meant to accommodate multiple cryptocurrency wallets with simple interfaces. This is usually due to the prioritization of security with the goal of minimizing user error. The primary reason for a lack of functionality, however, is the fact that you cannot download a cryptocurrency’s full blockchain onto a hardware wallet. In short, many features/functions that are specific to a single cryptocurrency (which often requires the downloading of the complete blockchain data) probably won’t be accessible on a hardware wallet (such as access to Ethereum DApps, which Mist provides).

Another disadvantage of a hardware wallet is the low storage capacity. Again, a hardware wallet won’t be capable of downloading a whole block chain. Hardware wallets also aren’t capable of holding as many wallets as you may want. Manufacturers attribute the lack of storage space to security requirements, as it is insecure to leave a lot of free room available. If you have several cryptocurrencies you wish to store on a hardware wallet, you may have to uninstall and reinstall wallet software as access is needed(private keys remain on the device, so it is not required to go through the full restoration process in many cases).

In addition to storage space restrictions, hardware wallets support a limited range of cryptocurrencies. This means that if a user buys a hardware wallet but wants to use an unsupported cryptocurrency, they must wait for the developers to add support for it (if they even choose to do so). Whereas desktops are capable of installing whatever wallet software supports the installed operating system.

Conclusion

This is very subjective and open to debate, but the general response you will get to this question is when you think you need to. Hardware wallets are portable themselves, but they require a computer (with the required software installed) to access their contents, making them not very convenient in all scenarios. The security and reliability benefits of this type of wallet encourage most users to use them for long term (cold) storage, or safe storage for a large amount of cryptocurrency. The term “large” is relative and depends on your definition, but once you start losing sleep over the thought of losing your cache of crypto, it’s probably a good time to pick up a hardware wallet.

Others would advise you to purchase one immediately and use it to store your primary stash, as it is truly one of the safest means of cryptocurrency storage. It is really up to you to decide when it’s worth the cost of the device, but it’s generally seen as unnecessary for non-serious investors or hobbyists with small amounts of money invested. Hardware wallets are perfect for those with a high amount of cryptocurrency that they don’t want to lose to a malicious actor.

Online Wallets

What are online wallets?

Online wallets are cryptocurrency wallets that are accessible using a web browser. These wallets vary in function and design greatly across different services, but they all have similar inherent advantages and disadvantages.

Advantages of an online wallet

Online wallets are, by far, the most convenient way to store cryptocurrency. They are accessible by any device with an internet browser, and they do not require the downloading of blockchain data. All relevant data is centrally stored on a server owned by the developer of the wallet.

Disadvantages of an online wallet

This type of wallet is insecure and lacks many features that are specific to individual cryptocurrencies. Your private keys are not held by you. Security methods, of course, vary between service, but at the end of the day, it takes a massive amount of trust to use such a service. For example, a service may claim that you are the only one with half of the private key, and the service only retains the other. How can you trust the service to not be lying to you? What if the service is not responsibly handling your private keys, and a malicious actor hacks and steals your precious coins? What if the company steals the coins themselves?

Conclusion

An online wallet should be used when convenience is valued above all else. It is best to not keep long-term investments on this type of wallet. However, smaller amounts meant to be used for quick, on-the-fly transactions could be considered perfectly fine for storage on these wallets. A user must be able to trust the service they’re using. It’s best to do thorough research on a service before using their wallet.

Paper Wallets

What are paper wallets?

“Paper wallet” is a loose term, typically used to describe printing private and public keys onto a physical document in order to store cryptocurrency offline. These keys can be later used to access the wallet through various software.

Advantages of a paper wallet

Paper wallets are extremely secure if generated/created in trustworthy environments. If you use an online service (this is generally discouraged), you must be able to trust that service to not keep a record of your keys. Paper wallets are offline (cold storage), so they cannot be “hacked” or attacked by malicious actors using digital means. No centralized authority has to be trusted with holding your keys. These wallets can also be used for the easy physical transfer of cryptocurrency, as transferring can be as easy as handing a slip of paper to another person. However, this requires trust from the receiving party. Paper wallets are fantastic for long term storage.

Disadvantages of a paper wallet

Paper wallets are the most inconvenient to use and are really only a method of cold storage. If a user wants to access the funds, they must generate the wallet in software, and thus remove the offline (cold) aspect of the wallet. The only way to keep the wallet offline but send the value would be the physical transfer of the wallet document, which requires a great deal of trust in the transaction as the other party could suspect you of lying about the value.

Conclusion

Paper wallets should only be used in situations where funds need to be stored long-term, or in situations where a user wants to easily give cryptocurrency locally to someone like a friend or family member.

Exchange Wallets

What are exchange wallets?

Exchange wallets are wallets stored on a cryptocurrency exchange. Whenever you send money to an exchange like Coinbase, your coins are stored in one of these wallets. These wallets are hosted by the exchange and the private keys are owned by the exchange. For all intents and purposes, they are web wallets integrated into an exchange’s site.

(Buy $100 worth of Bitcoin at Coinbase using our referral link and help support us!)

Advantages of an exchange wallet

Exchange wallets are easy and simple to use, and have a relatively low chance of user error. They also allow for the easy use of exchange services, such as converting one cryptocurrency to another (available on exchanges like Bittrex) or converting to fiat currency (available on exchanges like Coinbase).

Disadvantages of an exchange wallet

Exchange wallets have extremely limited functionality, as all they can typically do is be deposited in, withdrawn from, and used to access exchange services. Also, any cryptocurrency stored on them is not your own. The exchange controls the private key and therefore your funds. If the exchange is attacked or a disgruntled employee takes advantage of slacking security, your funds are at risk. You must completely trust the exchange to protect your investments. This makes long-term storage a dangerous gamble.

Conclusion

It is typically advised to use exchange wallets for as short a time as possible. Only use them when you need to access exchange services, such as crypto-to-crypto conversion or cashing out for that Tesla. Don’t use these wallets for a very long time, as every second of storage requires a great amount of trust. Remember Mt. Gox?

Which type of wallet is best?

The simple answer is, use whichever fits your use-case the most? Are you an investor “hodling” for the long term? A hardware or a paper wallet may work best for you. Or are you a risky day trader? In that case, an exchange wallet may be your preferred method. Are you a crypto enthusiast that wants the most out of this wild ride? A desktop wallet may be perfect for you! Are you a shopaholic, but also a politically involved crypto-anarchist? An online wallet may be the best solution.

In reality, you may want to just use a combination of them, if not every one. Keep your savings in a paper wallet and your rainy day fund in a hardware wallet. Throw your beloved cryptocurrency into an exchange when you need to trade, and deposit some into an online wallet for quick spending cash. Whatever wallets you decide to use will depend on your personal ideals and concerns, but more importantly, it depends on your purpose for using cryptocurrency.